BitMEX in 2025: The Exchange’s Return with a Focus on Institutional Traders

In early 2025, BitMEX, one of the pioneers of the cryptocurrency derivatives market, made a significant comeback by repositioning itself towards institutional investors. After a turbulent few years marked by regulatory hurdles and operational changes, the platform now aims to regain its place among the industry’s leaders. The new strategy focuses on transparency, compliance, and offering sophisticated trading tools tailored for large-scale traders.

Renewed Institutional Focus and Product Innovation

BitMEX has completely redesigned its services to meet the evolving needs of institutional clients. The platform now offers a full suite of trading products, including futures, options, and perpetual swaps, all underpinned by enhanced compliance frameworks. This strategic pivot reflects BitMEX’s recognition of the growing demand for regulated crypto derivatives from hedge funds, asset managers, and proprietary trading firms.

Another notable change is the introduction of portfolio margining, allowing clients to optimise their capital efficiency across various positions. By implementing risk-based margin models, BitMEX offers institutions the flexibility to trade large volumes without unnecessary collateral burdens. This feature significantly differentiates the platform from less sophisticated exchanges still relying on isolated margin models.

Security has also been prioritised, with a revamp of custodial solutions. BitMEX now integrates multi-signature cold storage technologies and insurance mechanisms to protect institutional assets. Clients benefit from enhanced operational security standards, meeting the expectations of traditional finance players entering the crypto markets.

Strategic Partnerships and Licensing Achievements

In 2025, BitMEX successfully secured several key regulatory approvals, including licences from the Financial Conduct Authority (FCA) in the United Kingdom and the Monetary Authority of Singapore (MAS). These achievements have opened doors to new client segments that previously required trading partners to meet stringent regulatory standards.

Additionally, BitMEX has partnered with institutional-grade service providers such as Fireblocks and Chainalysis to bolster security and compliance layers. This commitment to high standards sends a clear signal to the market: BitMEX is fully committed to serving professional traders and maintaining transparent operations in all jurisdictions where it operates.

Such collaborations not only enhance trust among existing clients but also attract new investors seeking a secure and regulated environment for digital asset trading. In a competitive industry landscape, these moves firmly position BitMEX among the top choices for institutional crypto derivatives trading.

Technological Advancements and Trading Infrastructure

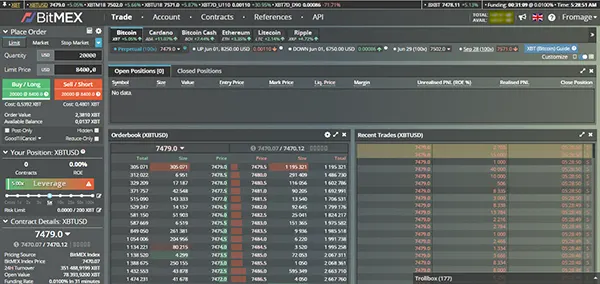

BitMEX’s technology infrastructure has undergone a complete transformation to support its new institutional focus. The platform now offers sub-millisecond latency, supporting high-frequency trading (HFT) strategies and algorithmic trading at a level comparable to traditional equity exchanges.

A robust Application Programming Interface (API) suite enables seamless integration with proprietary trading systems. Enhanced order types, such as iceberg orders and advanced time-in-force instructions, provide institutions with the flexibility needed for complex trading strategies. Moreover, real-time risk monitoring tools ensure that portfolio exposures are accurately assessed at all times.

In addition to speed and flexibility, BitMEX has also strengthened its disaster recovery and redundancy capabilities. Clients can now expect near-zero downtime, even in volatile market conditions. These technical enhancements underline the exchange’s commitment to institutional-grade reliability and performance standards.

Customised Solutions and Client Support

Recognising the diverse needs of institutional clients, BitMEX has launched a range of customised solutions. White-glove account management services are available, offering dedicated relationship managers who understand the unique operational requirements of each client.

Educational initiatives have also been expanded. Institutions can now access exclusive webinars, research papers, and market analysis produced by BitMEX’s in-house experts. These resources help traders stay ahead of market trends and regulatory developments, adding significant value beyond the trading platform itself.

Finally, the support framework has been overhauled. A 24/7 institutional helpdesk ensures that critical issues are addressed promptly, with a clear escalation pathway for complex or high-impact matters. This client-centric approach is critical for building long-term partnerships with professional trading firms.

Market Impact and Future Outlook

Since its institutional relaunch, BitMEX has recorded a steady increase in trading volumes, particularly from European and Asian asset managers. Analysts attribute this success to the platform’s ability to balance regulatory compliance with technological sophistication, an achievement that few competitors have fully matched.

The exchange’s growing presence has also introduced greater competition into the institutional crypto derivatives space. As a result, other exchanges have started upgrading their offerings to meet higher expectations, ultimately benefiting the wider market and improving service quality across the board.

Looking ahead, BitMEX plans to further expand into emerging markets, including Latin America and Africa. By leveraging its new regulatory credentials and enhanced technological capabilities, the platform aims to capitalise on untapped growth opportunities while continuing to refine its institutional services portfolio.

Conclusion: A New Chapter for BitMEX

BitMEX’s transformation in 2025 marks a new era for the exchange. By focusing on institutional needs, securing regulatory approvals, and investing heavily in infrastructure, BitMEX is no longer simply a pioneer of crypto derivatives—it is positioning itself as a mature, trusted player in the global financial markets.

With an unyielding emphasis on transparency, innovation, and client service, BitMEX appears well-equipped to not only regain its former prominence but to set new standards for excellence in the industry. As the landscape continues to evolve, BitMEX’s commitment to serving institutions ensures that it remains at the forefront of the next wave of crypto financial innovation.