Bitpanda in 2026: does it suit Europeans for buying, selling and long-term holding?

If you live in Europe, Bitpanda often appears as a straightforward way to buy crypto with EUR and keep everything under one account. The more important question is whether it still makes sense once you move beyond a first purchase—especially if you plan to hold long term, buy regularly, or trade more actively. This guide focuses on what typically matters most in 2026: regulation context, cost transparency, funding and limits, and the real trade-offs between custodial storage and moving assets to self-custody.

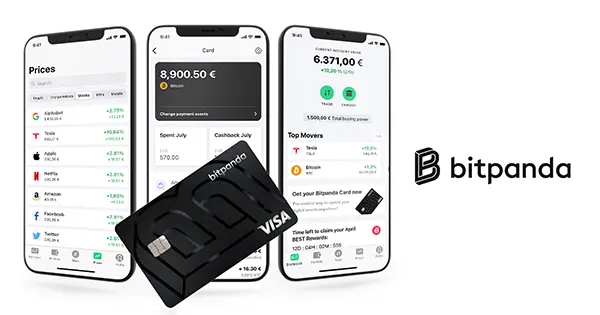

What Bitpanda looks like in 2026 for European users

In 2026, European crypto services operate under stricter expectations than a few years ago, and compliance has become part of everyday user experience. For most people, this shows up as clearer verification requirements, more structured transaction monitoring, and occasional extra checks when funding or withdrawing. The upside is that rules are becoming more standardised across the EU, even if the experience can feel more “formal” than before.

Bitpanda is primarily built around convenience: quick EUR funding, a simple interface, and an investing-style flow that suits newcomers as well as long-term holders who do not want to manage complex order books. That ease of use is a genuine advantage, but it can also make people ignore the small details that matter later—such as limits per payment method, or how the final price is formed on instant conversions.

Reliability also matters in real life, not only in product descriptions. Any service can have maintenance windows or occasional disruptions, so it is sensible to treat access to funds as something you plan around rather than assume is perfect 24/7. If you depend on fast access during volatile markets, you should factor this operational reality into your decision.

Transparency: where costs hide (and how to read them)

With user-friendly crypto services, the main cost trap is expecting a single “trading fee” line like on a classic exchange. In practice, instant conversions often include a spread or a built-in premium in the quoted price. The safest habit is simple: before confirming any purchase or sale, read the trade preview and treat the shown total as your real cost, not just the headline fee you may have in mind.

If you buy regularly, small differences in all-in pricing add up. A weekly or monthly routine can turn a minor premium into a noticeable annual cost. To stay honest with yourself, keep a basic record of what you paid and what you received, and periodically compare your average execution price to a reputable market reference at the time of each order.

For users who trade more actively, execution quality becomes more important than convenience. If your approach involves frequent entries and exits, the “easy” purchase flow is often not the most cost-efficient. In that case, you should prioritise tools designed for tighter execution and clearer pricing, and only trade actively if you understand the risks of fast-moving markets and your own behaviour under stress.

Three practical strategies: buy and hold, regular buys, active trading

Buy and hold works best when your goal is long-term exposure rather than timing the market. Here, the important decision is not only what you buy, but where you store it. Keeping assets with a custodian is convenient, yet it adds counterparty risk; self-custody reduces reliance on a third party, but it shifts responsibility for security entirely onto you.

Regular purchases are mostly about consistency and friction. Your routine should be: choose a funding method you can repeat reliably, confirm that limits will not block you in heavier months, and test both a deposit and a withdrawal early. People often test buying but postpone testing withdrawals, then discover unexpected delays or method restrictions at the worst possible moment.

Active trading is where most mistakes happen, because it rewards discipline and punishes impulse. If you plan to trade frequently, you need clear rules for position sizing, stop levels, and maximum daily or weekly loss. Without hard limits, active trading tends to become emotional decision-making, and emotional decision-making tends to become expensive.

Fiat on/off ramps and limits that matter in everyday use

In 2026, banking friction is still part of crypto life. Some payments go through smoothly, while others can trigger extra verification steps depending on your bank, your transaction pattern, or the payment rail. This does not necessarily mean something is wrong, but it does mean you should plan for occasional delays and not rely on “last-minute” funding for time-sensitive decisions.

Limits are not a small-print detail—they shape what you can actually do. Deposit and withdrawal thresholds often differ by payment method, verification status, and internal risk rules. If your strategy involves larger infrequent buys, confirm that your preferred method supports those volumes; if your strategy involves frequent smaller purchases, make sure the minimums and any per-transaction costs do not quietly erode your results.

A good habit is to build a simple “stress test” of your setup: a small deposit, a small trade, and a small withdrawal. Do this before you move meaningful money. It gives you a real sense of timing, fees, and the practical steps involved, so you are not learning under pressure.

Long-term storage and risk management: what the service does, what you must do

Long-term holding is less about short-term price moves and more about risk control. If you keep assets with a custodian, you rely on their security, governance, and operational resilience. That can be a reasonable choice, but it is still a choice that carries a distinct risk profile compared to self-custody.

If you hold for years, consider splitting funds into two buckets. Keep a smaller “active” portion on the service for convenience, and move a larger “deep storage” portion to self-custody if you are capable of managing keys securely. This reduces the impact of any single failure mode, whether it is account access issues, operational disruption, or your own mistakes during a rushed withdrawal.

Personal security basics matter more than most people admit. Use strong authentication, avoid reusing passwords, keep your recovery options secure, and be cautious with new devices. Most losses in real life are not Hollywood-level hacks—they are account takeovers, phishing, and avoidable mistakes that happen when someone is tired, rushed, or overconfident.

Who it won’t suit in 2026

If your core strategy depends on complex derivatives or highly specialised trading features, a consumer-oriented investing flow may feel limiting. In that scenario, you would usually look for a venue built specifically around professional trading requirements, and you would also accept the higher risk that comes with leverage and complex products.

If you want ultra-fast execution for high-frequency tactics, you are likely to be dissatisfied. Even when a service offers more advanced trading tools, the overall ecosystem is typically optimised for mainstream users, not for latency-sensitive strategies that depend on microseconds and perfect order routing.

Finally, if you prefer self-custody by default and rarely keep assets with any custodian, then the service may only make sense as a fiat on/off ramp. In that case, your priorities should be smooth EUR funding, predictable limits, and a clean withdrawal path to your own wallet rather than using the account as your long-term storage location.