DEX vs CEX in 2026: What Is Actually Safer for Beginners and Where Most Mistakes Happen

By 2026, cryptocurrency exchange has become far more accessible than it was just a few years ago. A newcomer can open an account on a centralised exchange within minutes or connect a non-custodial wallet to a decentralised protocol and swap tokens directly on-chain. Yet accessibility does not equal safety. The real question for a beginner is not which model sounds more “advanced”, but which environment reduces the likelihood of irreversible errors, loss of funds, or exposure to fraud. In this article, I will break down how CEX and DEX models work today, what risks are typical for each, and where beginners most often make costly mistakes.

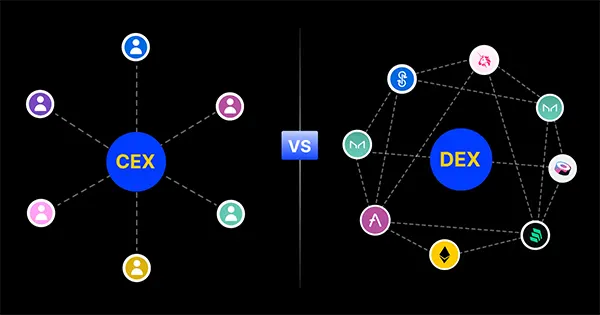

How CEX and DEX Actually Work in 2026

A centralised exchange (CEX) in 2026 operates as a regulated intermediary. It holds user funds in custodial wallets, matches buy and sell orders internally, and often provides additional services such as staking, derivatives, fiat on-ramps and card integrations. Most major CEXs now implement mandatory KYC, transaction monitoring and proof-of-reserves reporting, following stricter global compliance standards introduced after 2022–2024 industry failures.

A decentralised exchange (DEX), by contrast, is built on smart contracts deployed on blockchains such as Ethereum, BNB Chain, Arbitrum or Solana. Users trade directly from their own wallets, interacting with automated market makers (AMMs) or on-chain order books. There is no central custodian; instead, liquidity pools and algorithms determine pricing and execution.

In practical terms, the key difference is custody. On a CEX, the exchange controls private keys. On a DEX, the user does. This distinction defines the entire risk profile. If a CEX fails, funds may be frozen. If a user mishandles a wallet on a DEX, there is no recovery mechanism. Safety, therefore, depends on who bears operational responsibility.

Custody, Regulation and Technical Complexity

By 2026, many reputable CEXs operate under clearer regulatory frameworks in the EU, UK and parts of Asia. The EU’s MiCA regulation has formalised licensing requirements, capital reserves and consumer disclosures. For beginners, this reduces counterparty uncertainty compared with the largely unregulated landscape of earlier years.

DEXs, however, remain protocol-based systems. While front-end interfaces may comply with local rules, the smart contracts themselves are permissionless. A user interacts directly with blockchain infrastructure. This offers censorship resistance but demands technical awareness: gas fees, slippage settings, token approvals and wallet security are not abstract concepts—they directly affect outcomes.

For a newcomer, technical complexity often becomes the first hidden risk. Sending tokens to the wrong network, approving malicious contracts, or misunderstanding slippage tolerance can result in permanent loss. On a CEX, similar errors are often mitigated by interface warnings or customer support.

What Is Actually Safer for a Beginner?

From a purely operational standpoint, a well-regulated and established CEX is generally safer for a complete beginner in 2026. The main reason is error containment. Most mistakes—incorrect memo fields, unsupported networks, or accidental transfers—can sometimes be resolved through support channels. Identity verification also adds a recovery pathway if account access is lost.

However, “safer” does not mean risk-free. Counterparty risk still exists. Even with proof-of-reserves audits and segregation policies, users depend on the exchange’s solvency and governance. History has shown that mismanagement, fraud or liquidity crises can occur despite compliance frameworks.

DEXs eliminate counterparty custody risk but shift full responsibility to the user. For individuals who understand seed phrase storage, hardware wallets and smart contract risk, DEXs can be safer in terms of long-term self-custody. For beginners unfamiliar with private key management, that same autonomy becomes the primary danger.

Psychological Risk vs Technical Risk

On CEX platforms, beginners often face psychological risks rather than technical ones. Easy access to leveraged trading, perpetual futures and margin products can encourage overexposure. Losses frequently stem from speculative behaviour rather than infrastructure failure.

On DEXs, technical risk dominates. Rug pulls, malicious tokens, fake liquidity pools and phishing websites remain common in 2026. While blockchain transparency has improved analytical tools, a newcomer may not recognise warning signs such as locked liquidity duration, contract ownership privileges or abnormal tokenomics.

In short, CEX risk is typically behavioural and institutional; DEX risk is technical and irreversible. Understanding which category you are more likely to mismanage is critical when choosing where to start.

Where Beginners Make the Most Expensive Mistakes

The most frequent CEX mistake in 2026 is treating an exchange account as a long-term storage solution. Although many exchanges now publish reserve attestations, they are not equivalent to self-custody. Large balances kept indefinitely on a custodial account increase exposure to operational and regulatory risk.

Another common error is misunderstanding network compatibility during deposits and withdrawals. Sending USDT via the wrong blockchain standard can still result in complex recovery procedures or permanent loss, especially when smaller exchanges lack advanced recovery tools.

On DEXs, the most expensive mistake remains poor wallet security. Storing a seed phrase digitally, signing blind transactions, or interacting with unverified contracts can drain funds instantly. In 2026, wallet-draining malware and sophisticated phishing campaigns continue to evolve, often mimicking legitimate interfaces with near-perfect design copies.

Practical Safety Framework for 2026

For beginners, a hybrid approach is often the most rational strategy. Use a reputable, regulated CEX for fiat onboarding and simple spot purchases. Transfer long-term holdings to a hardware wallet once the balance becomes meaningful. This reduces both exchange counterparty exposure and hot wallet vulnerability.

If using DEXs, start with established protocols that have undergone multiple independent audits and have significant total value locked (TVL). Always verify contract addresses through official documentation, double-check token symbols, and limit approval allowances rather than granting unlimited permissions.

Above all, treat cryptocurrency exchange as a financial operation, not a casual experiment. Whether interacting with a CEX or DEX in 2026, the biggest losses rarely come from technology itself—they come from haste, overconfidence, and ignoring basic operational discipline.